Thursday, April 30th—today's news: oil giant Shell cuts dividends for the first time since WW2. European markets await the ECB meeting, cryptocurrency market surged $35 billion in the last 24 hours propelled by a jump in bitcoin. EUR/USD is at 1.0878, GBP/USD—1.2494; Brent oil is $26.20 per barrel, gold is $1,729.35. Read the daily selection of analytical reviews from Grand Capital experts to navigate the market during a time of volatility.

The pair is rising amid the growing demand for risk assets in anticipation of today’s ECB monetary policy meeting. It’s not expected to result in a decision to extend the stimulus measures. This would be positive for the currency, which is ahead of the dollar in this regard. Positive news on the coronavirus pandemic in Italy and Spain serve as an additional stimulus for the growth. Keep track of the rate changes in real time.

Trading recommendations: sell below 76.28; stop loss: 76.50; target levels: 76.09, 75.87, 75.59.

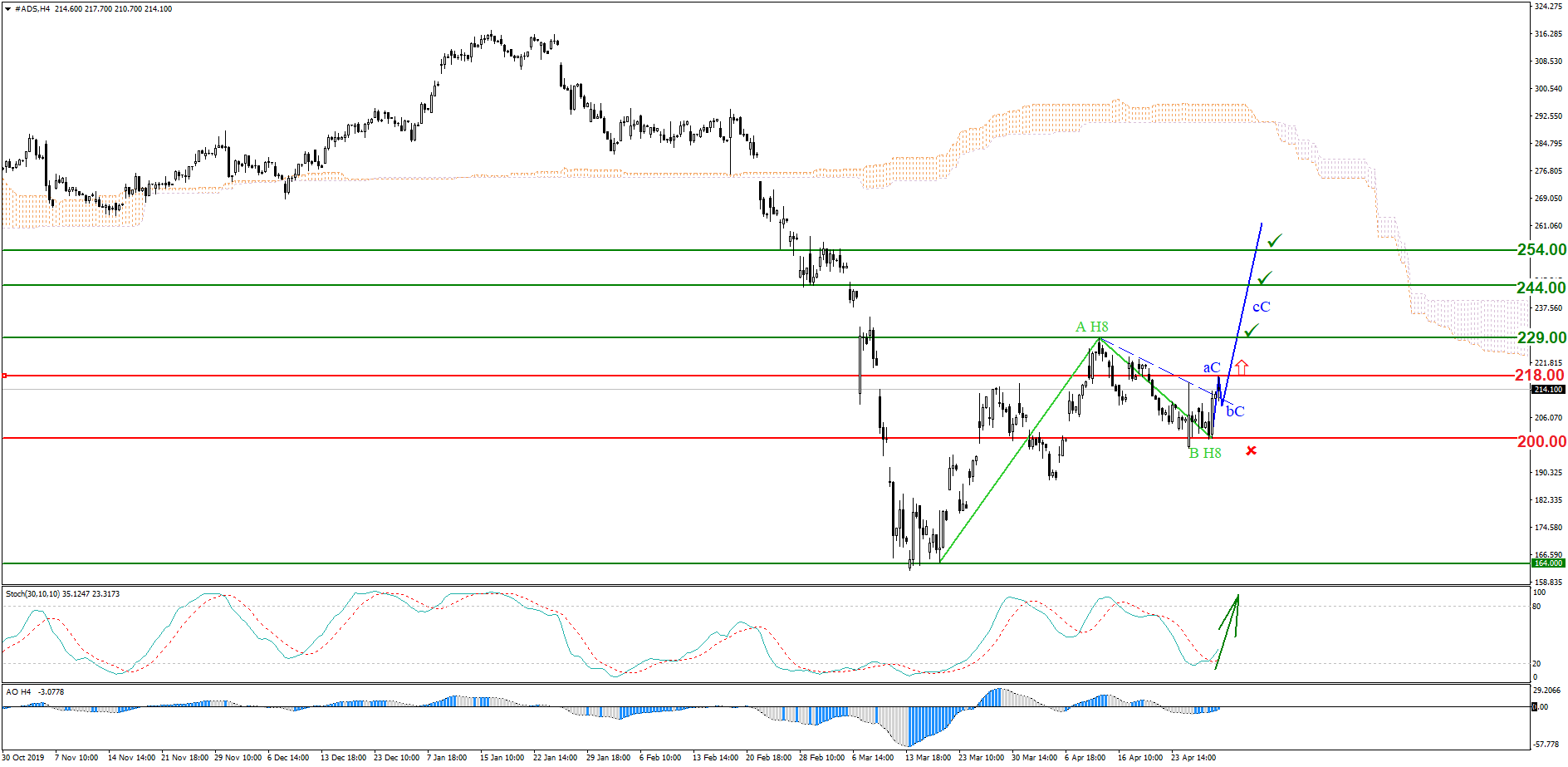

Global stock markets are recovering as the lockdowns are eased. The downward presumed correction (H8 wave) ended with a breakdown of the inclined channel. Breakout of the level 218 will result in the formation of an ascending wave pattern within the wave C of an ascending level H8 pattern. Stochastic Oscillator signals oversoldness. Keep track of the rate changes in real time.

Trading recommendations: buy above 218.00; stop loss: 200.00; target levels: 229.00, 244.00, 254.00.

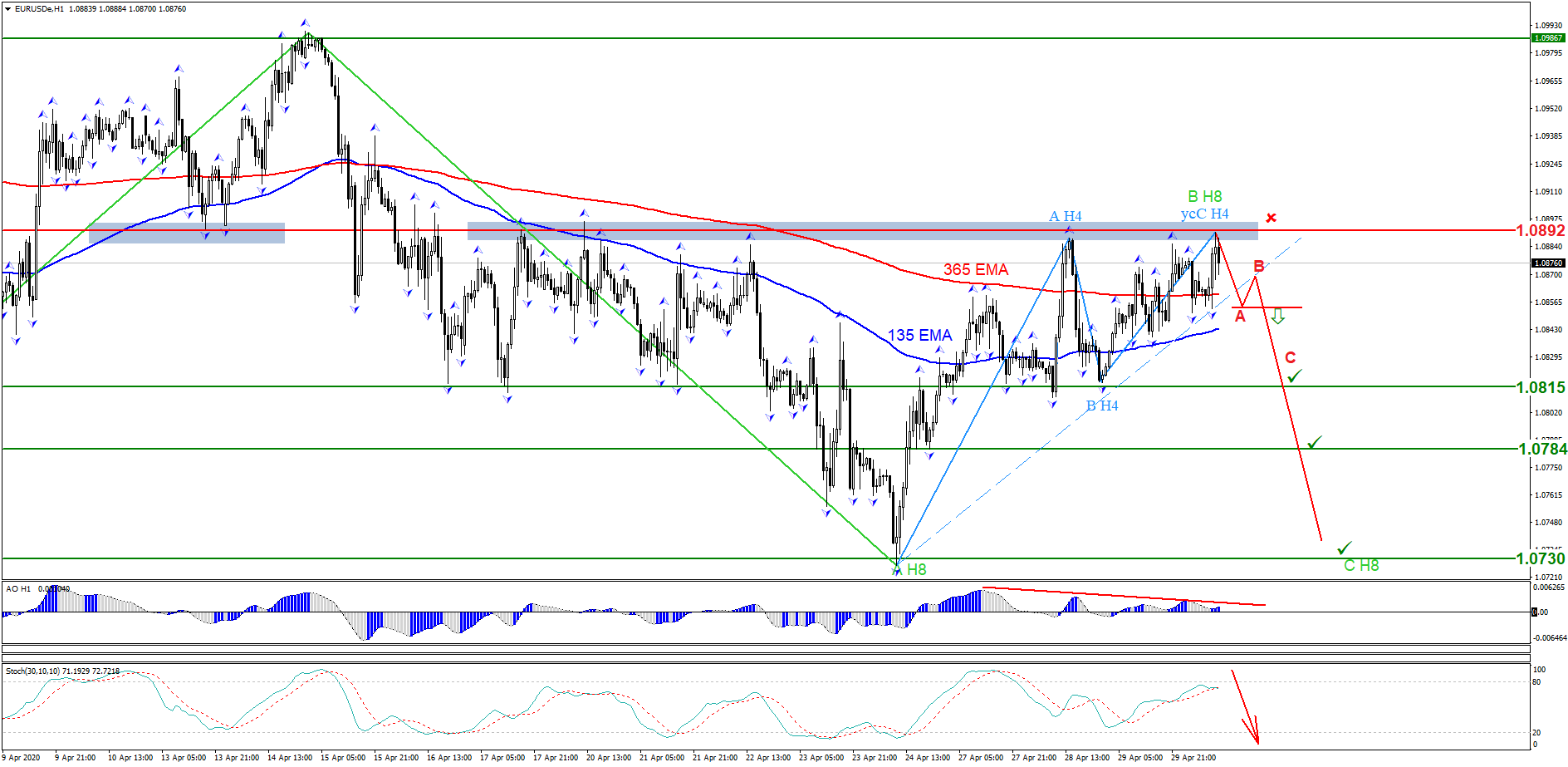

The price pivot zone of 1.0892 is actively holding back buyers. A bearish divergence has formed on Awesome Oscillator, and Stochastic Oscillator signals overboughtness. The ascending H4 level pattern is truncated. Keep track of the rate changes in real time.

Trading recommendations: sell while a descending wave pattern is forming, where wave A breaks through the inclined channel of the ascending truncated H4 level pattern.

Visit the new section on Grand Capital website to monitor the rate changes of your preferred instruments and get useful information to help you decide on a trading strategy.

*Trading recommendations offered by analysts do not constitute a solicitation. Before starting to trade on currency exchange markets, please make sure that you understand the risks connected with the use of leverage and that you have sufficient level of training.