Wednesday, April 29th—today's news: Fitch cuts Italy's credit rating to just one notch above junk. The US dollar remains a safe bet for investors, Dow Jones is rising on the optimism over the economy's reopening and the Fed extending the stimulus. EUR/USD is at 1.0867, GBP/USD—1.2441; Brent oil is $23.57 per barrel, gold is $1,719.50. Read the daily selection of analytical reviews from Grand Capital experts to navigate the market during a time of volatility.

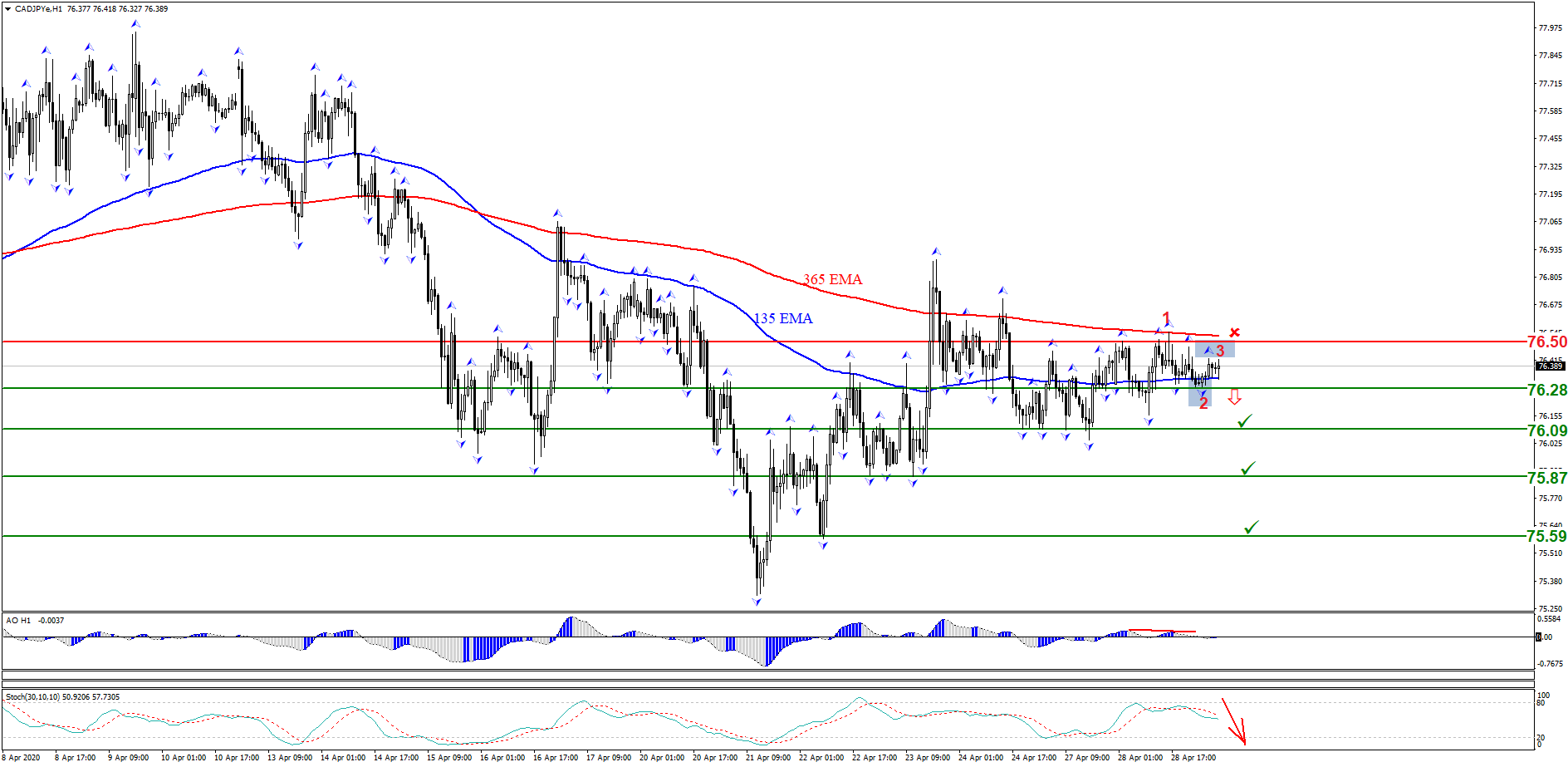

The overall trend is downward. A start fractal has formed below the 135 moving average, followed by a signal fractal. A breakout of the start fractal will result in the formation of a descending 1-2-3 pattern and a breakout of the price pivot zone of 76.28. A bearish divergence has formed on Awesome Oscillator, and the moving averages of Stochastic Oscillator are directed down from the overbought zone. Keep track of the rate changes in real time.

Trading recommendations: sell below 76.28; stop loss: 76.50; target levels: 76.09, 75.87, 75.59.

The US is gradually lifting the COVID-19 lockdown. It’s because of those restrictions that the Boeing shares had fallen. The stock is trading in a downward price channel. A bullish divergence has formed on Awesome Oscillator, and the moving averages of Stochastic Oscillator have moved out of the oversold zone. Keep track of the rate changes in real time.

Trading recommendations: buy strictly while an ascending 1-2-3 pattern is forming above the upper border of the descending price channel.

The pair continues to be supported by the growing demand for risk assets as the coronavirus impact is waning, and the lockdowns are gradually being lifted around the world. These developments, as well as the Fed’s final decision to extend the massive economic stimulus until the end of the year will support the positive market sentiment and strengthen the position of the Canadian national currency against the US dollar. Keep track of the rate changes in real time.

Trading recommendations: sell the pair after its decline below 1.3940 with a probable fall to 1.3860.

Visit the new section on Grand Capital website to monitor the rate changes of your preferred instruments and get useful information to help you decide on a trading strategy.

*Trading recommendations offered by analysts do not constitute a solicitation. Before starting to trade on currency exchange markets, please make sure that you understand the risks connected with the use of leverage and that you have sufficient level of training.