Monday, April 27th—today's news: traders turn away from the US dollar as countries announce easing of coronavirus restrictions. The EU markets are trading higher due to the same reason, shares of European airlines rise on government bailouts EUR/USD is at 1.0849, GBP/USD—1.2433; Brent oil is $23.91 per barrel, gold is $1,736.90. Read the daily selection of analytical reviews from Grand Capital experts to navigate the market during a time of volatility.

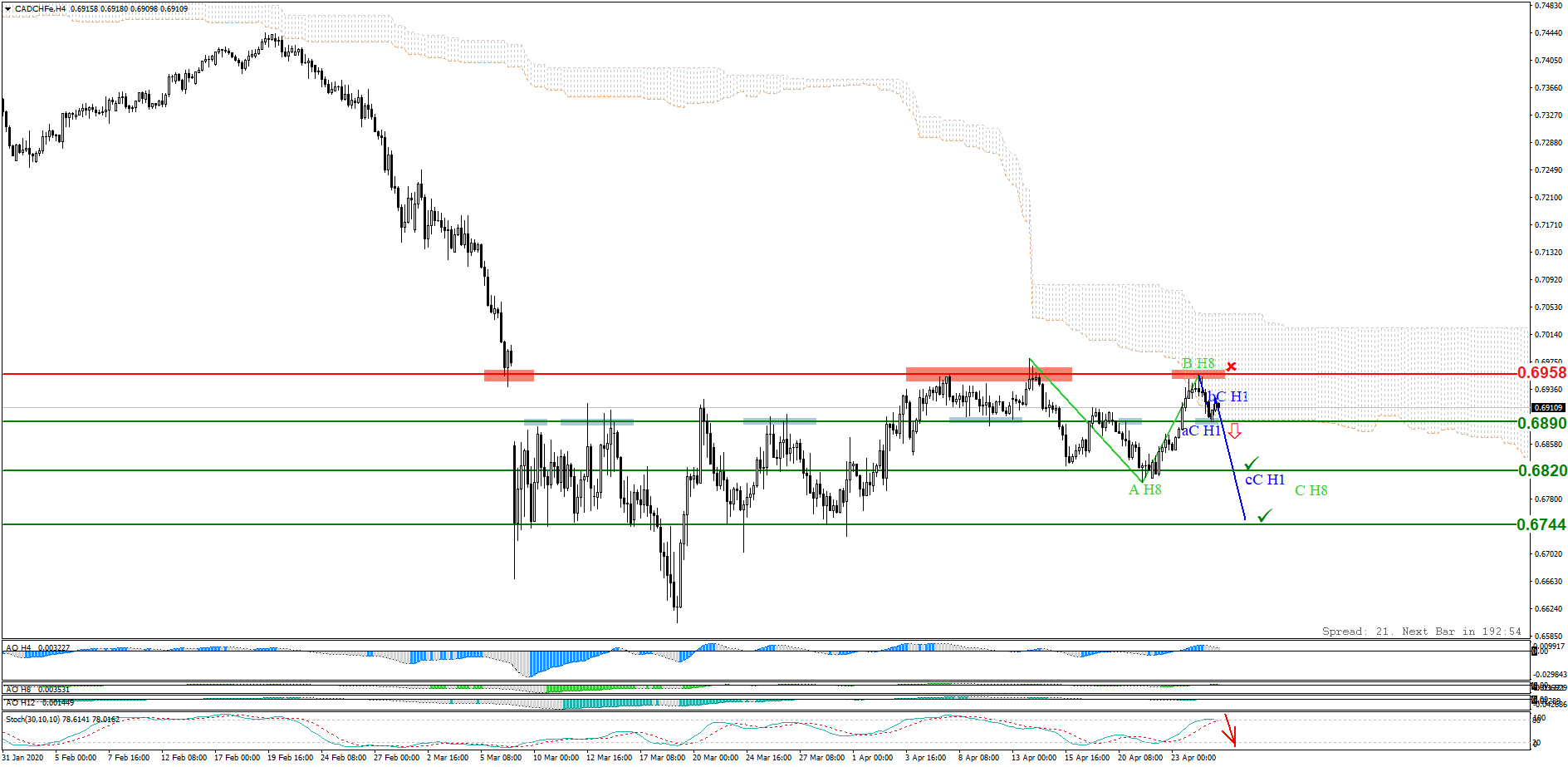

The price pivot zone of 0.6958 holds back buyers. Stochastic Oscillator signals overboughtness. Breaking through the price pivot zone of 0.6890 will result in the formation of a descending H1 level pattern within the wave C of the descending H8 level pattern. Keep track of the rate changes in real time.

Trading recommendations: sell below 0.6890; stop loss: 0.6958; target levels: 0.6820, 0.6744.

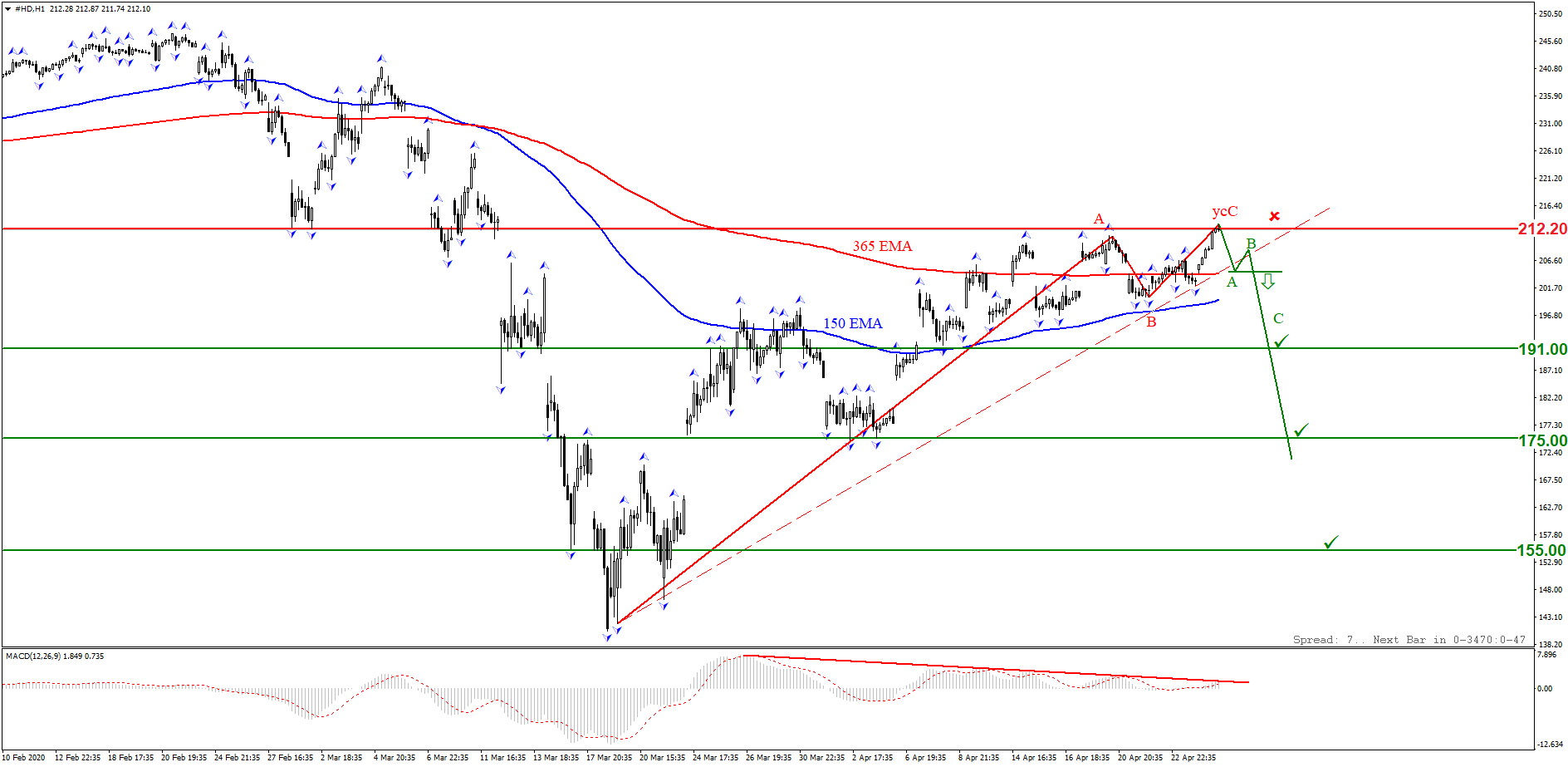

The price pivot zone of 212.20 deters buyers. The ascending wave pattern is truncated. A bearish divergence has also formed on MACD. Keep track of the rate changes in real time.

Trading recommendations: sell while a descending wave pattern is forming, where wave A breaks through the inclined channel of an ascending pattern, completing it.

The pair is turning down, despite the new drop in crude oil prices. The Fed’s two-day monetary policy meeting is in the market’s focus: it’s to start on Tuesday and to end on Wednesday with a new interest rate decision. Jerome Power isn’t expected to give any new statements on this topic at the press conference. The pair is likely to continue falling amid the optimism over the pandemic subsiding, and the decrease of interest in the US dollar as a safe haven currency. Keep track of the rate changes in real time.

Trading recommendations: sell the pair after it crosses 1.4045 with a probable decline to 1.3985.

Visit the new section on Grand Capital website to monitor the rate changes of your preferred instruments and get useful information to help you decide on a trading strategy.

*Trading recommendations offered by analysts do not constitute a solicitation. Before starting to trade on currency exchange markets, please make sure that you understand the risks connected with the use of leverage and that you have sufficient level of training.