Tuesday, June 23rd, today’s news — Asian stock indexes are mostly rising, recovering initial losses, following a rally in the US stock market supported by high-tech companies. Oil prices are falling after a strong rise the day before due to uncertainty around the fate of the US-China trade deal. The price of Brent oil today is $42.93 per barrel, WTI — $40.51. EUR/USD is at 1.129; GBP/USD — 1,248; gold is $1.764,35. Read the daily selection of analytical reviews from Grand Capital experts to navigate the market during a time of volatility.

Every morning on weekdays, our new Chief Analyst Vladimir Rojankovski in his videos talks about political decisions with market implications, global economy news, announcements from central banks and major companies, news of large economic events. Subscribe to our YouTube channel and never miss an update!

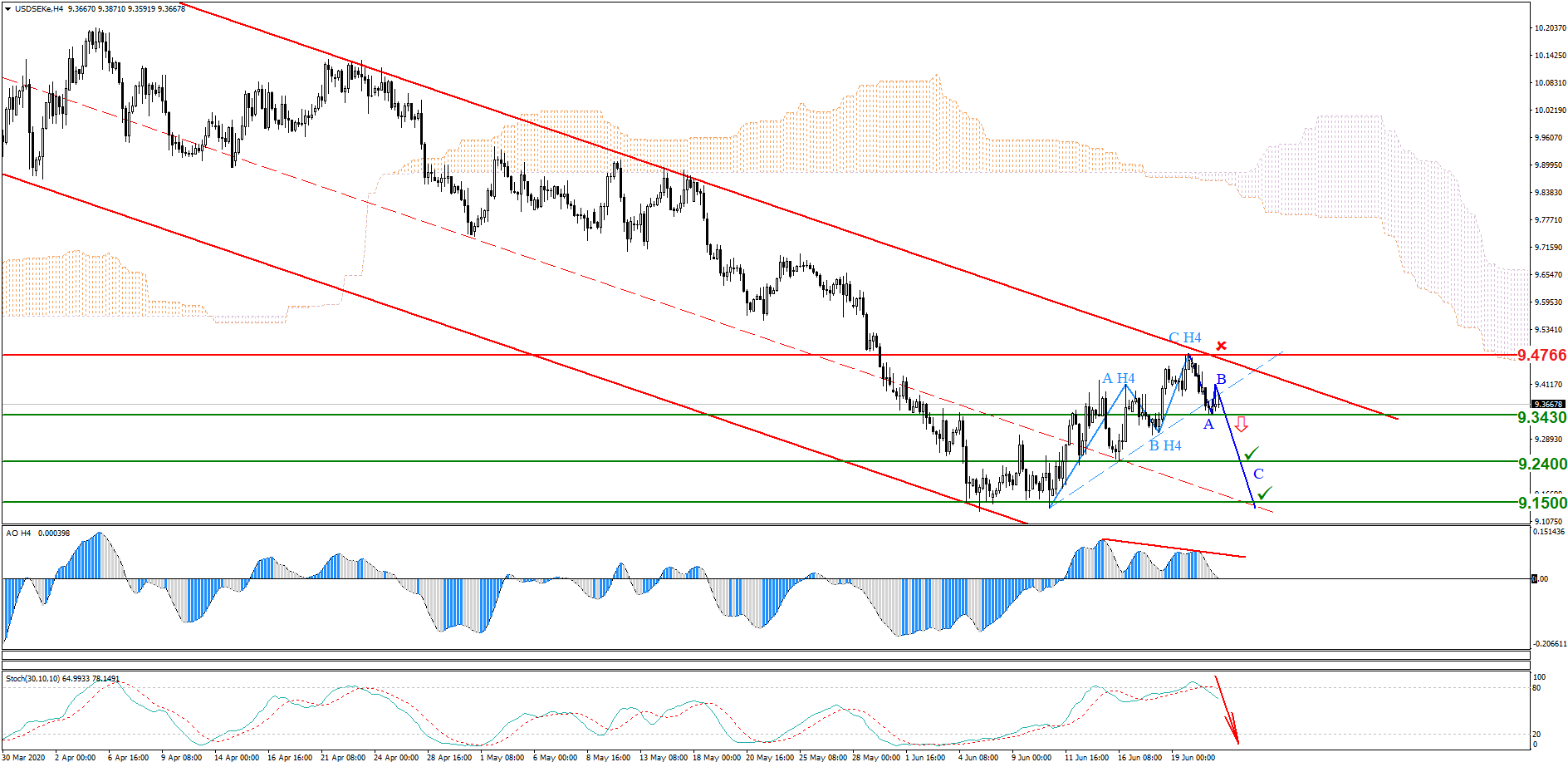

The currency pair is trading in the upper line of the descending price channel. A bearish divergence has formed on Awesome Oscillator indicator, and Stochastic Oscillator indicator signals overboughtness. A breakout of 9.3430 will result in the formation of a descending wave pattern within the overall downtrend.

The USDSEK rate online: monitor the movement of the pair in real time.

Trading recommendations: sell below 9.3430. Stop loss: 9.4766. Target levels: 9.2400; 9.1500. .

The pair receives support amid the rising demand for risky assets after a statement by Donald Trump’s trade adviser Peter Navarro, who said on Tuesday that the US is not ending trade relations with China. This positive signal can be supported by the pair along with the data on business activity indices published today in the manufacturing and non-manufacturing sectors of Germany and the eurozone, if they turn out to be no worse than expected.

The EURUSD rate online: monitor the movement of the pair in real time.

Trading recommendations: the growth of the pair above the level of 1.1280 may lead to its further growth to 1.1350.

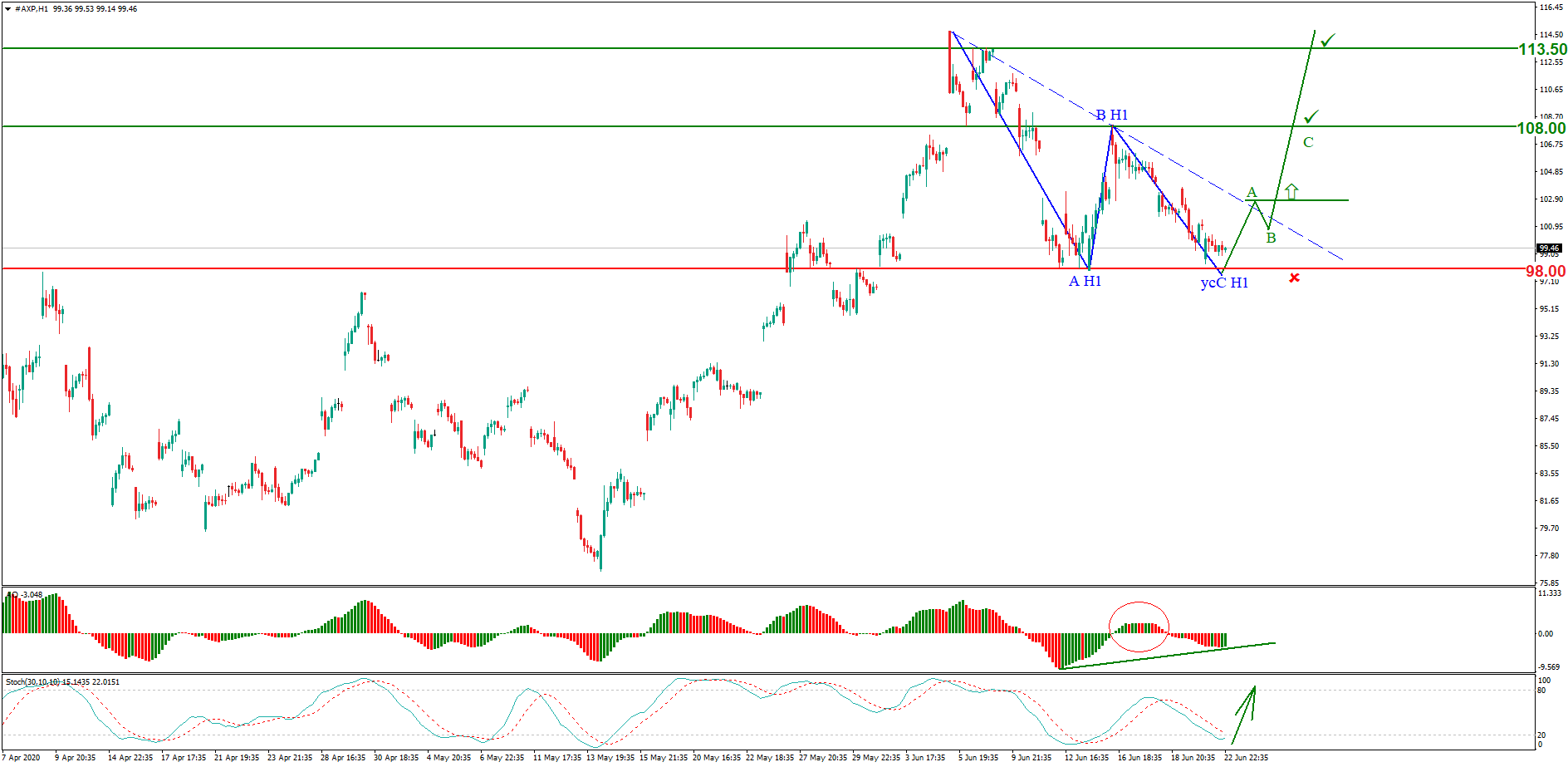

The overall trend is upward. The 98.00 support level is holding back sellers. A descending truncated pattern of the H1 level has formed. Awesome Oscillator indicator shows a bullish divergence, while Stochastic Oscillator indicator signals oversoldness.

The #AXP shares rate online: monitor the movement of the shares in real time.

Trading recommendations: buy while an ascending wave pattern is forming, where the wave (A) breaks through the inclined channel of the descending truncated pattern of the H1 level. Stop loss: 98.00. Target levels: 108.00; 113.50.

Visit the new section on Grand Capital website to monitor the rate changes of your preferred instruments and get useful information to help you decide on a trading strategy.

*Trading recommendations offered by analysts do not constitute a solicitation. Before starting to trade on currency exchange markets, please make sure that you understand the risks connected with the use of leverage and that you have sufficient level of training.