Wedneday, June 3rd—today's news: China's service sector returns to growth for the first time since January. The US markets rise amid the optimism over the economic recovery, shares of European companies also rise. EUR/USD is at 1.1211, GBP/USD—1.2585; Brent oil is $39.91 per barrel, gold is $1,720.75. Read the daily selection of analytical reviews from Grand Capital experts to navigate the market during a time of volatility.

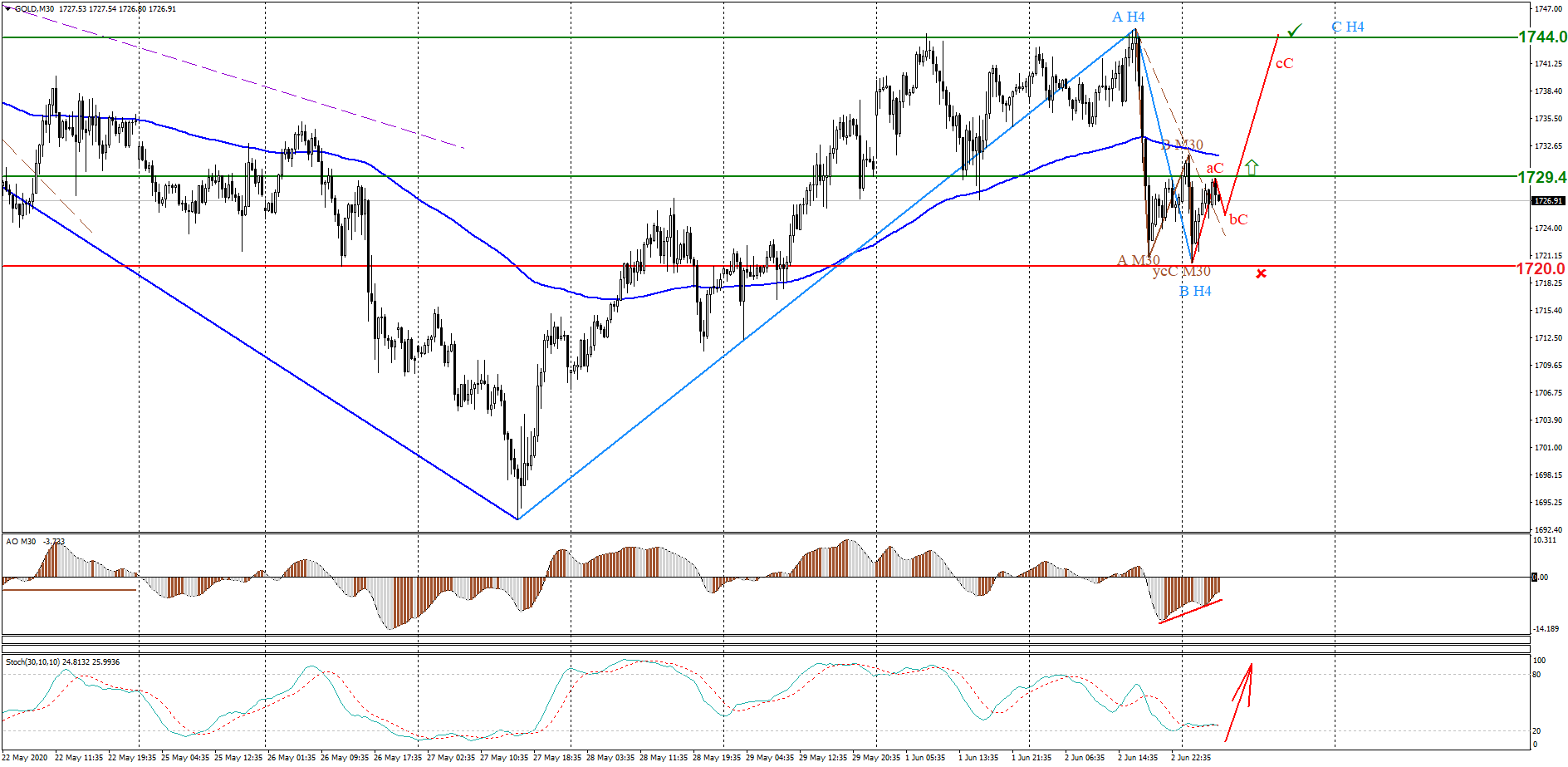

The support level 1720.0 is holding back sellers. A downward truncated M30 level pattern has formed, it ended with the breakout of an inclined channel. Awesome Oscillator shows a bullish divergence, while Stochastic Oscillator signals oversoldness. The breakout of 1729.40 will result in the formation of an ascending pattern within the wave (C) of the H4 level. Keep track of the rate changes in real time.

Trading recommendations: buy above 1729.40; stop loss: 1720.0; target levels: 1744.0, 1753.0; if the price falls to the support level of 1720.0, cancel the trading plan.

Stock markets are showing strong growth amid the easing of quarantine measures. Airbus Group shares look undervalued in comparison with other companies, having regained only a small part of the lost positions. The support level of 48.18 with a bullish divergence has held back sellers. Stochastic Oscillator shows a steady growth from the oversold zone. Keep track of the rate changes in real time.

Trading recommendations: buy above 64.22; stop Loss: 57.00; target levels: 74.60, 90.00.

The pair is at 1.1200, supported by the strong growth in demand for risk assets amid the new signs of the global economic growth: recent manufacturing data in Europe, Asia, and the US. The pair may continue to consolidate if May’s unemployment data to be released today in Germany isn’t worse than the expected 200,000 after April’s 373,000. Keep track of the rate changes in real time.

Trading recommendations: if the pair fixes above 1.1200 amid the positive news from Germany, it will continue to grow first to 1.1240, and then to 1.1280.

Visit the new section on Grand Capital website to monitor the rate changes of your preferred instruments and get useful information to help you decide on a trading strategy.

*Trading recommendations offered by analysts do not constitute a solicitation. Before starting to trade on currency exchange markets, please make sure that you understand the risks connected with the use of leverage and that you have sufficient level of training.