Thursday, May 7th—today's news: European markets rise amid the unexpected recovery in China's exports. The UK GDP is to fall by 14% in 2020, the US markets await new jobless claims data. EUR/USD is at 1.0791, GBP/USD—1.2372; Brent oil is $31.06 per barrel, gold is $1,696.50. Read the daily selection of analytical reviews from Grand Capital experts to navigate the market during a time of volatility.

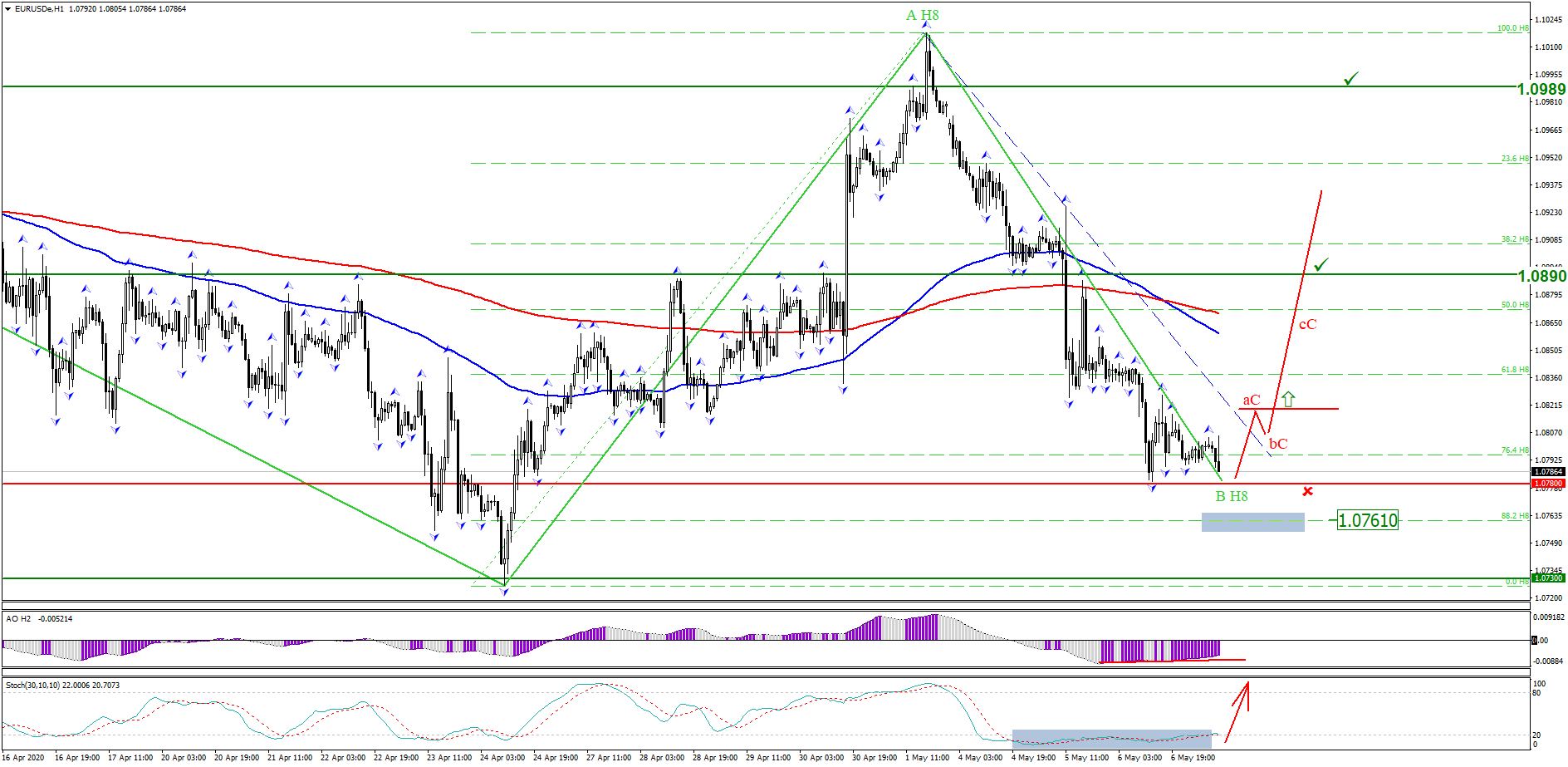

The round secondary level of 1.0780 is holding back sellers. Awesome Oscillator shows a bullish divergence, while Stochastic Oscillator signals oversoldness. The level of 88.2% of the assumed wave A H8 is not broken, this allows us to assume that the downward pattern is a correction wave on H8. Keep track of the rate changes in real time.

Trading recommendations: buy while an ascending pattern is forming, where wave A breaks through the inclined channel of the descending pattern.

The pair is consolidating in the range of 72.50–75.50 amid a surge of uncertainty regarding the global economy recovering from the coronavirus crisis, while the West, particularly the US, is blaming China for the COVID-19 pandemic. Today, the opening of trading in Russia is expected to be positive due to this morning’s favorable data from China. This may support the RUB. Keep track of the rate changes in real time.

Trading recommendations: sell the pair with a likely decrease to 72.50.

The price pivot zone of 83.90 is holding back sellers. A descending truncated H1 level pattern has formed. Awesome Oscillator shows a bullish divergence, while Stochastic Oscillator signals oversoldness. Keep track of the rate changes in real time.

Trading recommendations: buy strictly while an ascending wave pattern is forming, where wave A breaks through the inclined channel of the descending truncated H1 level pattern, completing it.

Visit the new section on Grand Capital website to monitor the rate changes of your preferred instruments and get useful information to help you decide on a trading strategy.

*Trading recommendations offered by analysts do not constitute a solicitation. Before starting to trade on currency exchange markets, please make sure that you understand the risks connected with the use of leverage and that you have sufficient level of training.