Wednesday, May 6th—today's news: researchers find a new, more contagious strain of COVID-19 in the US. European corporate profits drop amid the pandemic, the US-China trade war is about to escalate further, experts say. EUR/USD is at 1.0801, GBP/USD—1.2384; Brent oil is $31.19 per barrel, gold is $1,709.65. Read the daily selection of analytical reviews from Grand Capital experts to navigate the market during a time of volatility.

An ascending H2 level pattern has formed on the chart. The wave (A H2?) broke through the inclined channel of the descending pattern, the expected correction (on H2) tested 50% on Fibo and the price pivot zone of 1.4000. A breakout of 1.4078 will result in the formation of an ascending pattern within the wave C of the H2 level. Stochastic Oscillator also showed an exit from the oversold zone. Keep track of the rate changes in real time.

Trading recommendations: buy above 1.4078; stop loss: 1.4000; target levels: 1.4150, 1.4262.

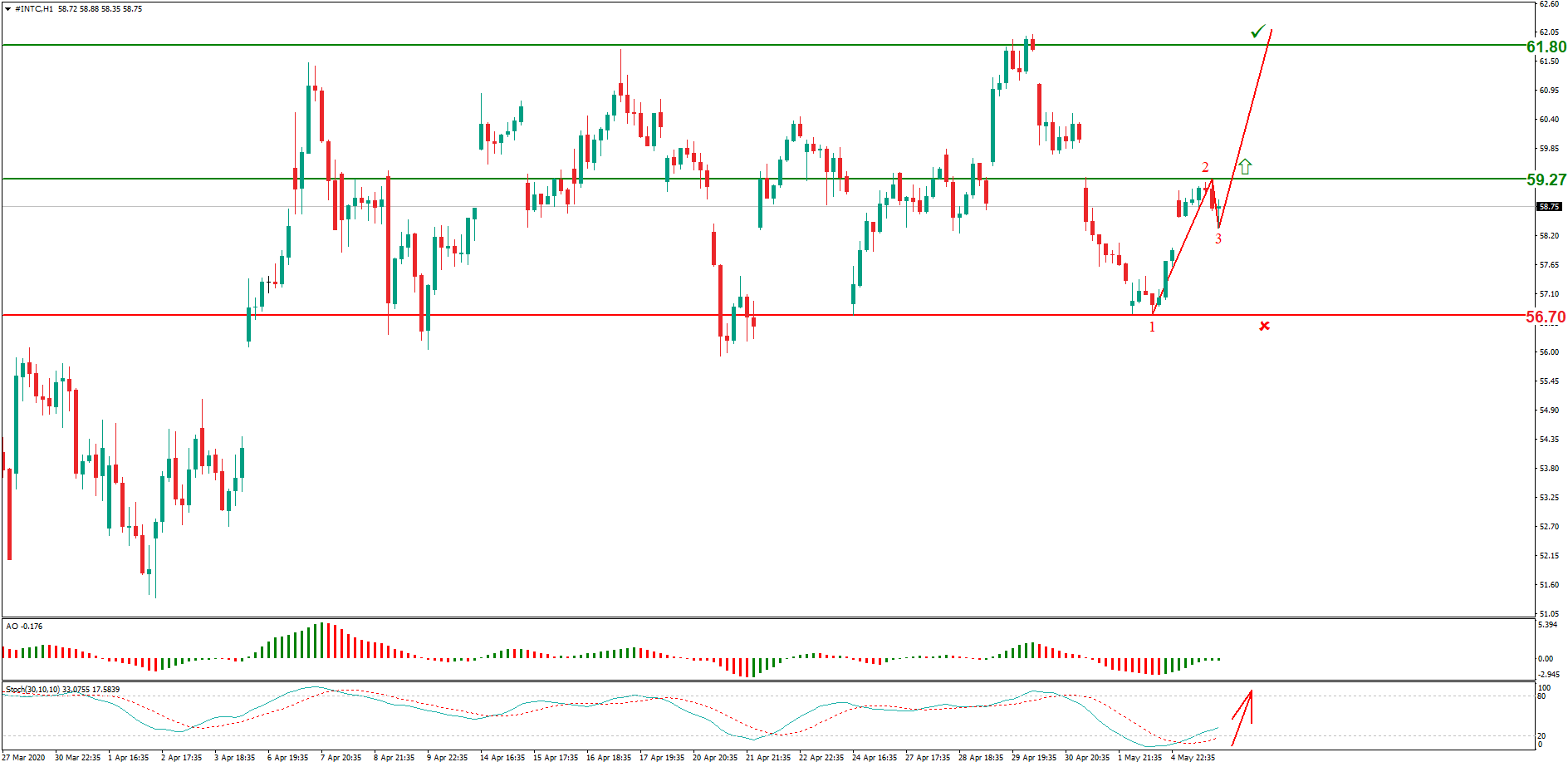

On April 20th, we already recommended buying Intel stock CFDs at the breakout level of 48.80. The shares are trading flat after the predicted growth, as can be seen now. The flat range’s lower border (56.70) is holding back sellers. A breakout of 59.27 will result in the formation of an ascending pattern 1-2-3. Stochastic Oscillator also showed an exit from the oversold zone. Keep track of the rate changes in real time.

Trading recommendations: buy above 59.27; stop loss: 56.70; target levels: 61.80, 67.60.

The pair remains under strong pressure as Germany’s constitutional court calls on the ECB to justify the broad stimulus measures, threatening to halt the Bundesbank’s participation in the scheme. If this situation comes to a standstill, the pair is likely to continue falling. Only the Bundesbank remaining in the camp of the "saviors" of Europe will support the euro. Keep track of the rate changes in real time.

Trading recommendations: sell the pair after it goes below 1.0820 with a likely further decline to 1.0750. At the same time, if it holds above 1.0820, and the market sentiment turns positive as Bundesbank’s participation in the stimulus measures is announced, the pair will turn up and head towards 1.1000.

Visit the new section on Grand Capital website to monitor the rate changes of your preferred instruments and get useful information to help you decide on a trading strategy.

*Trading recommendations offered by analysts do not constitute a solicitation. Before starting to trade on currency exchange markets, please make sure that you understand the risks connected with the use of leverage and that you have sufficient level of training.