Wednesday, May 13th—today's news: European markets slide amid the fears of the second wave of coronavirus as lockdowns are being lifted. The US dollar is trading higher ahead of the Fed's interest rate decision, the UK GBP shrank by record 5.8% in March. EUR/USD is at 1.0842, GBP/USD—1.2281; Brent oil is $29.32 per barrel, gold is $1,705.850. Read the daily selection of analytical reviews from Grand Capital experts to navigate the market during a time of volatility.

The 1.7200 support level is holding back sellers. Awesome Oscillator indicator shows bullish divergence, while Stochastic Oscillator signals oversoldness. The currency pair is trading in the upper bound of the descending price channel. Keep track of the rate changes in real time.

Trading recommendations: buy while an ascending 1-2-3 pattern is forming, where wave 1 breaks through the upper border of the descending price channel.

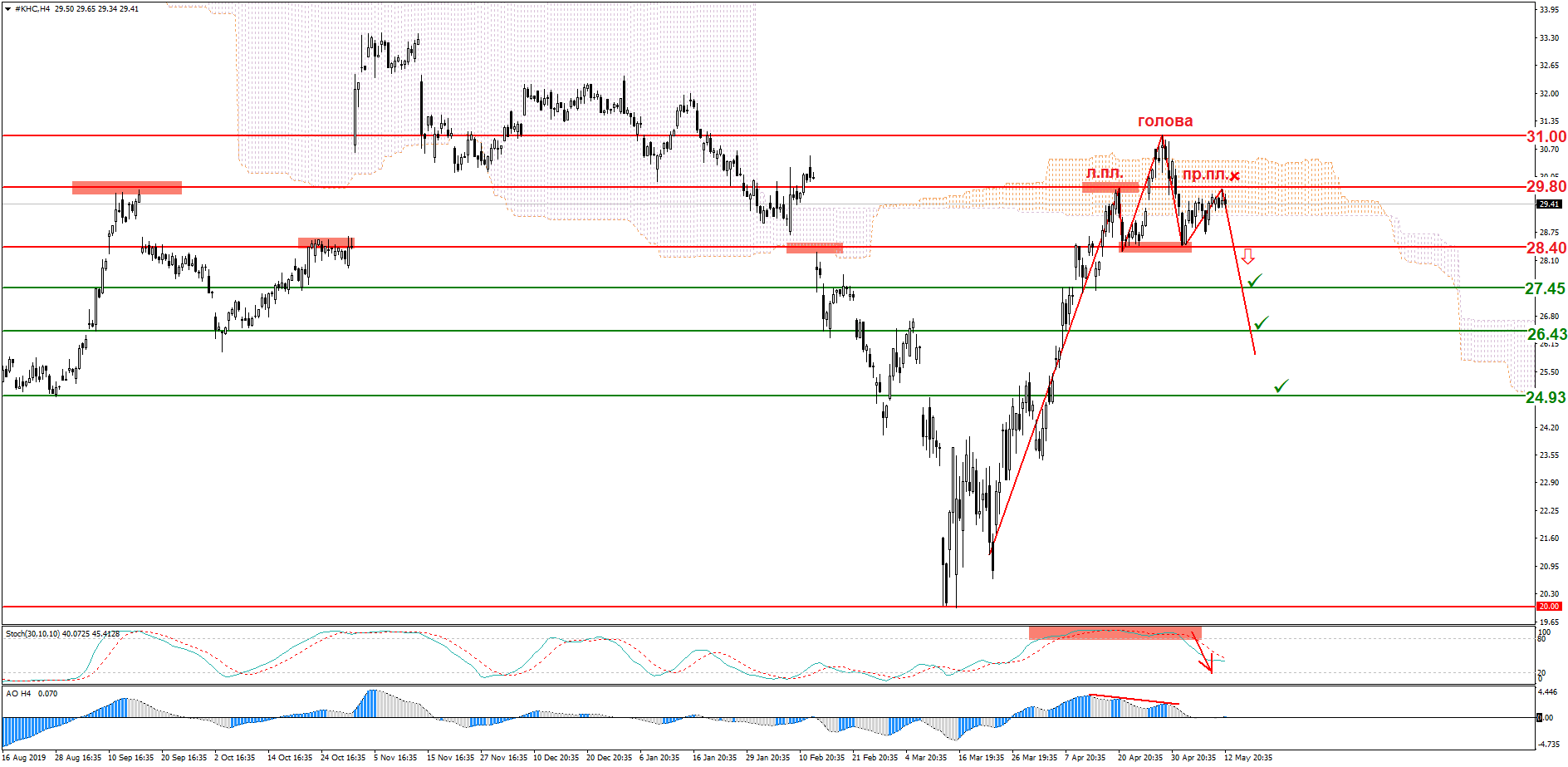

A multi-candle head and shoulders reversal model has formed on the H4 timeframe. The support level of 28.40 (neck line) is holding back the bears. Awesome Oscillator shows bearish divergence, while Stochastic Oscillator showed an exit from the overbought zone. Keep track of the rate changes in real time.

Trading recommendations: sell below 28.40; stop loss: 29.80; target levels: 27.45, 26.43, 24.93.

The pair is consolidating in a wide range of 1.2250–1.2555. Today it found support at 1.2250 amid the somewhat better UK economic statistics released today. Today, the market will be focused on Jerome Powell’s speech. If his outlook for the US economy is optimistic, and he clearly dismisses the possibility of negative interest rates by the Fed, the growth in demand for risk assets combined with the UK data may push the pair up. Keep track of the rate changes in real time.

Trading recommendations: buy the pair after it goes above 1.2310 with a possible target of 1.1440, and with a possibility of a further growth up to 1.2655.

Visit the new section on Grand Capital website to monitor the rate changes of your preferred instruments and get useful information to help you decide on a trading strategy.

*Trading recommendations offered by analysts do not constitute a solicitation. Before starting to trade on currency exchange markets, please make sure that you understand the risks connected with the use of leverage and that you have sufficient level of training.