Wednesday, May 20th—today's news: Dow futures rise again, continuing a very volatile week. European markets are trading lower as the attention of investors turns to the economic damage. EUR/USD is at 1.0953, GBP/USD—1.2248; Brent oil is $35.15 per barrel, gold is $1,753.80. Read the daily selection of analytical reviews from Grand Capital experts to navigate the market during a time of volatility.

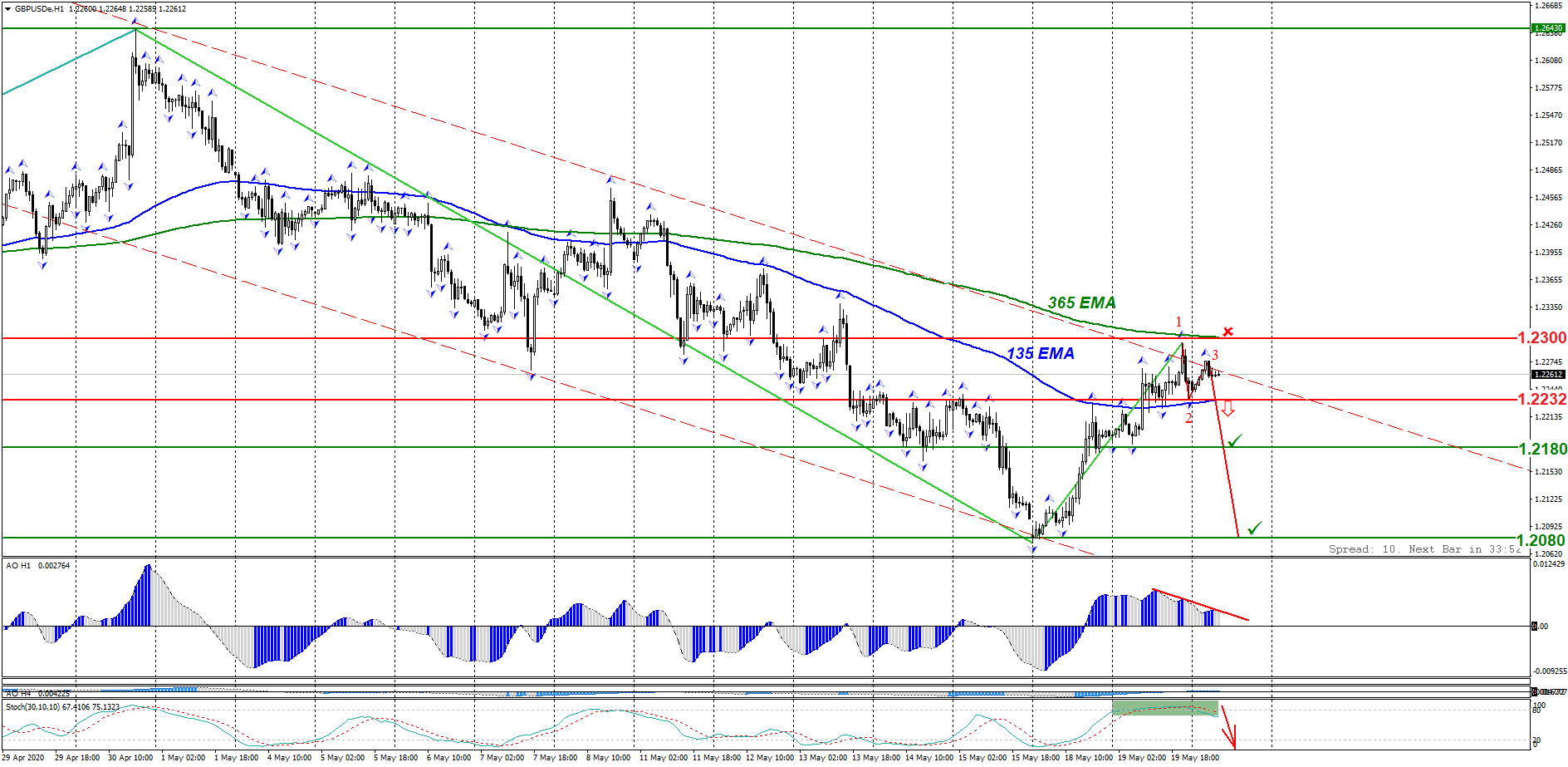

The pair signals the possibility of a downward turn amid the reduced risk appetite in the markets, increased demand for the US dollar, as well as weak consumer inflation data in the UK published this morning. Keep track of the rate changes in real time.

Trading recommendations: a decrease below 1.2245 may lead to a drop to 1.2160.

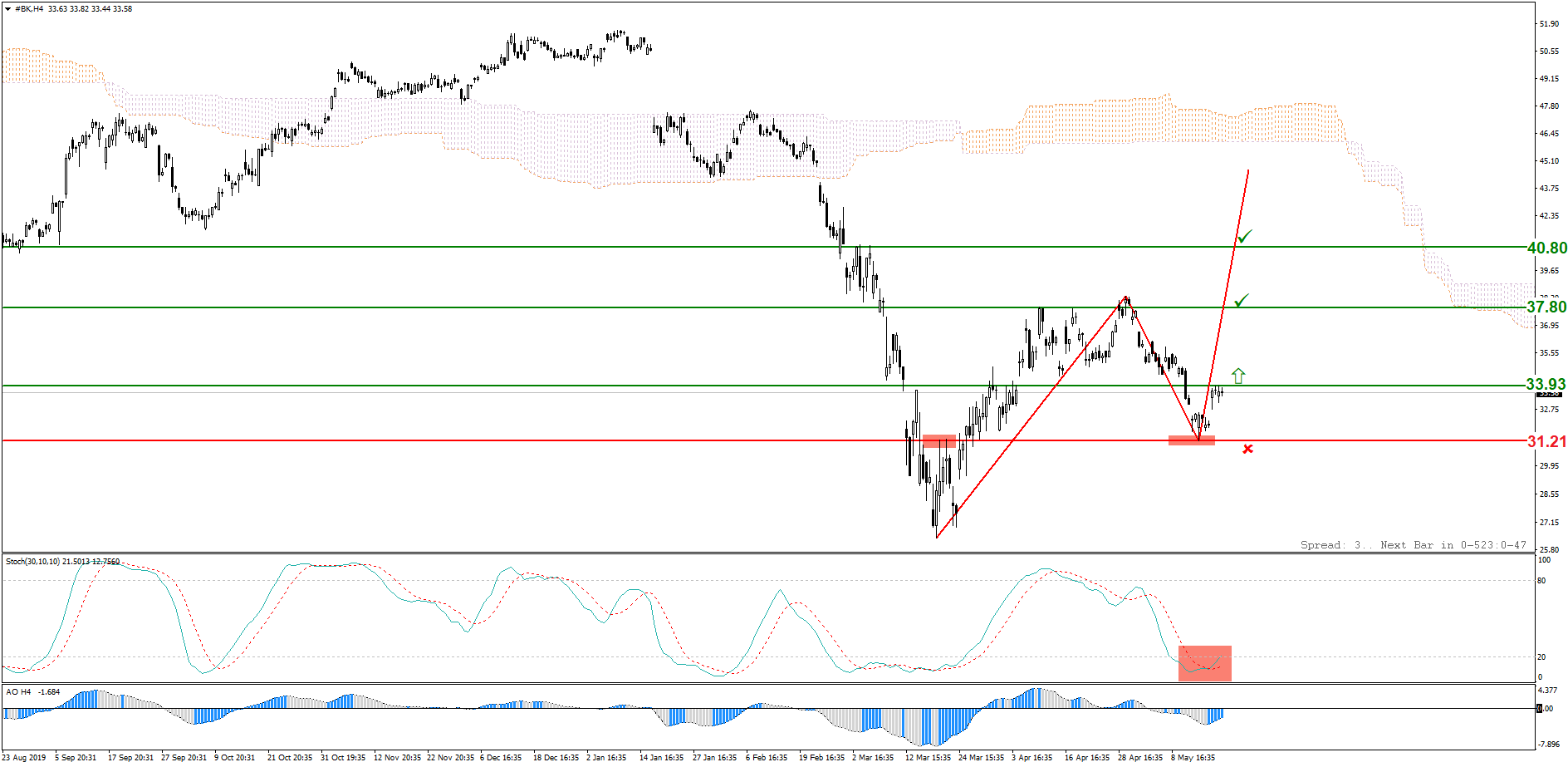

The 33.93 support level is holding back buyers. Stochastic Oscillator signals oversoldness. If the price fixes above the resistance level of 33.93, it will have an opportunity to rise within the range of a “specialist trap”—a reversal level of 37.80. Keep track of the rate changes in real time.

Trading recommendations: buy above 33.93; stop loss under the price pivot zone of 31.21; target levels: 37.80, 40.80.

The currency pair is trading in the range of 365 and 135 moving averages and the upper limit of the descending price channel. Awesome Oscillator shows a bearish divergence, while Stochastic Oscillator signals overboughtness. Breaking through the price pivot zone of 1.2232 will result in the formation of a 1-2-3 descending pattern. Keep track of the rate changes in real time.

Trading recommendations: sell below 1.2232; stop loss: 1.2300; target levels: 1.2180, 1.2080; in case of an upward movement in the range of 1.2300, cancel the trading plan.

Visit the new section on Grand Capital website to monitor the rate changes of your preferred instruments and get useful information to help you decide on a trading strategy.

*Trading recommendations offered by analysts do not constitute a solicitation. Before starting to trade on currency exchange markets, please make sure that you understand the risks connected with the use of leverage and that you have sufficient level of training.