Tuesday, June 16th, today’s news — the oil prices revived growth after yesterday's statement by the UAE Minister of Energy & Industry Suhail Mohamed Faraj Al Mazrouei about implementation of the OPEC+ agreement. The dollar depreciates after the US Fed’s announcement about buying corporate bonds. The Bank of Japan kept rates fixed at 0,1%. The Brent oil is $39,79 per barrel, WTI is $37,12. EUR rate is 1,13 USD, gold is $1 729,00.

Markets' Weather with Grand Capital Chief Analyst

Today Grand Capital new Chief Analyst Vladimir Rojankovski in its daily Market Weather talks about the Fed’s announcing of the corporate bonds and the consequent American stock market slight recovery. Subscribe to our YouTube channel and never miss an update!

USDCAD technical review

The pair price is correcting down amid the US Fed’s decision on Monday to expand its support of the national economy. It is one more important reason for the weaker US dollar. Also, the pair may go down if oil prices don’t turn down.

The price is under the middle Bollinger band, SМА 5, and SMA 14. Crossing movings give a sell signal. RSI is under the 50% and keeps going down.

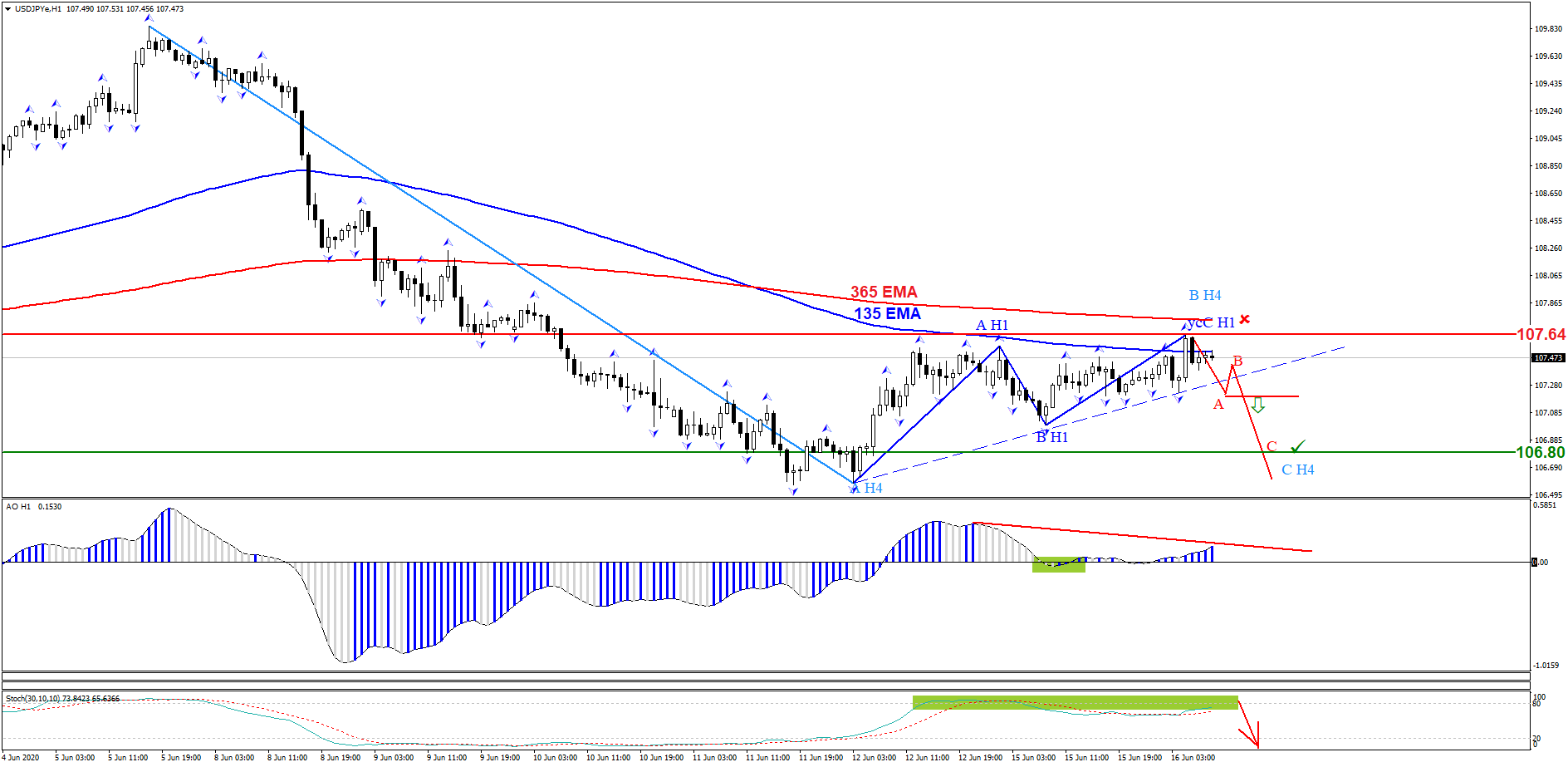

USDJPY analysis

The medium-term trend is downward. The pair is trading in the rage of 365 and 135 moving averages directed downwardly. The ascending H1 level pattern has been formed, that can be a wave (B) of a descending H4 level pattern. Awesome Oscillator indicates a Bearish divergence, and Stochastic Oscillator signals oversoldness.

Trading recommendations:

Sell while a descending wave pattern is forming, where the wave (A) breaks the inclined channel of the ascending H1 level truncated pattern.

Stop loss is at the local maximum (107.64).

Target levels: 106.80; 106.00.

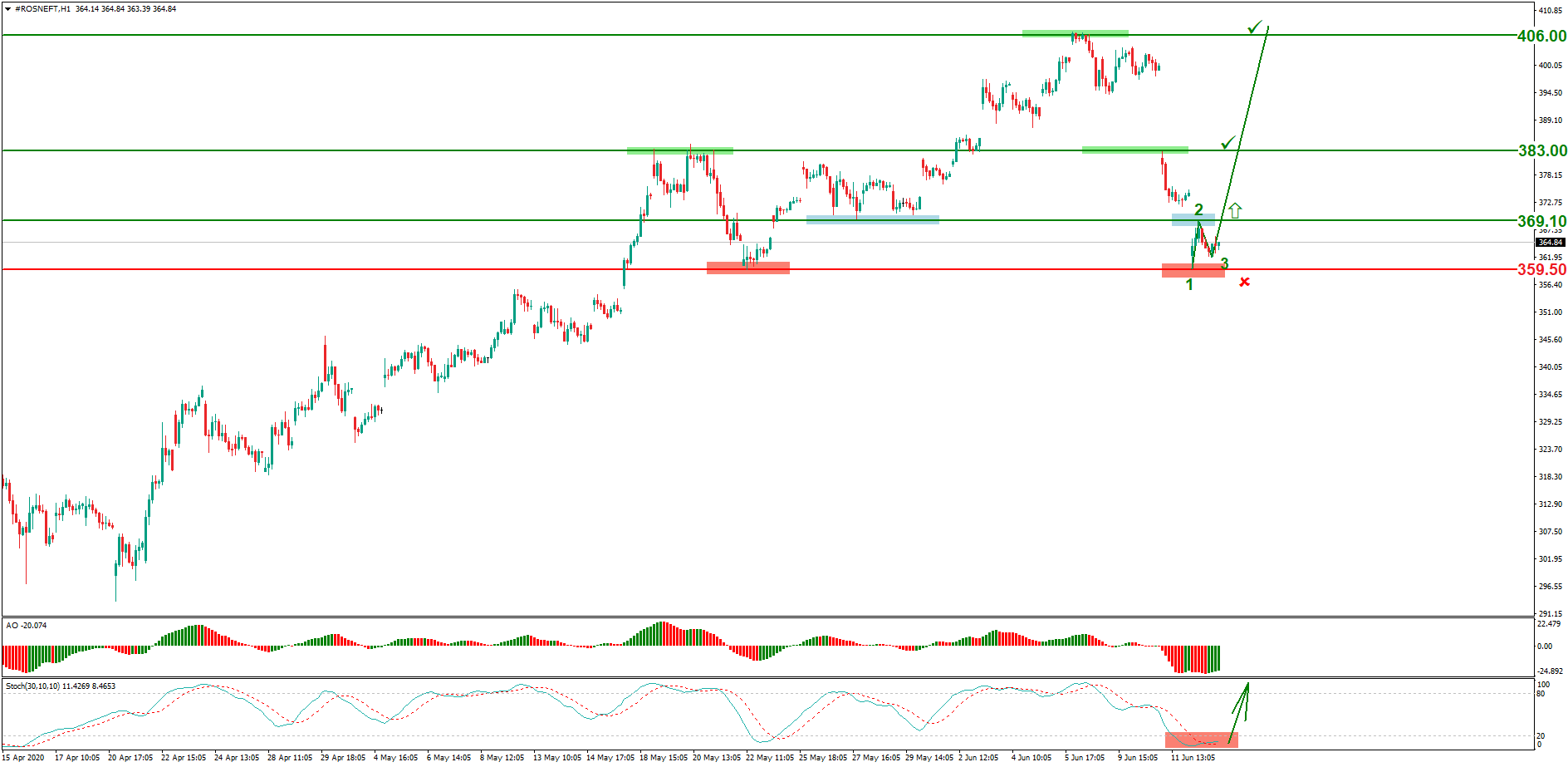

Trading ideas for ROSNEFT (ROSN)

The support level at 359.50 held back sellers. Breaking through the price pivot zone of 369.10 will let the 1-2-3 ascending pattern to be formed. Stochastic Oscillator signals oversoldness.

Trading recommendations:

Buy after the price pivot zone 369.10 is broken.

Stop loss: under the support level at 359.50.

Target levels: 383.00; 406.00

Useful info and online charts

Visit the new section on Grand Capital website to monitor the rate changes of your preferred instruments and get useful information to help you decide on a trading strategy.

*Trading recommendations offered by analysts do not constitute a solicitation. Before starting to trade on currency exchange markets, please make sure that you understand the risks connected with the use of leverage and that you have sufficient level of training.