Monday, March 30th—today's news: US, UK, and EU authorities say the lockdown may last up to 6 months. Futures return to negative trends and volatility after the last week's rally, analysts warn about a looming food crisis due to the coronavirus. EUR/USD is at 1.1084, GBP/USD—1.2405, both falling; Brent oil is $22.82 per barrel, gold is $1,621.70. Read the daily selection of analytical reviews from Grand Capital experts to navigate the market during a time of volatility.

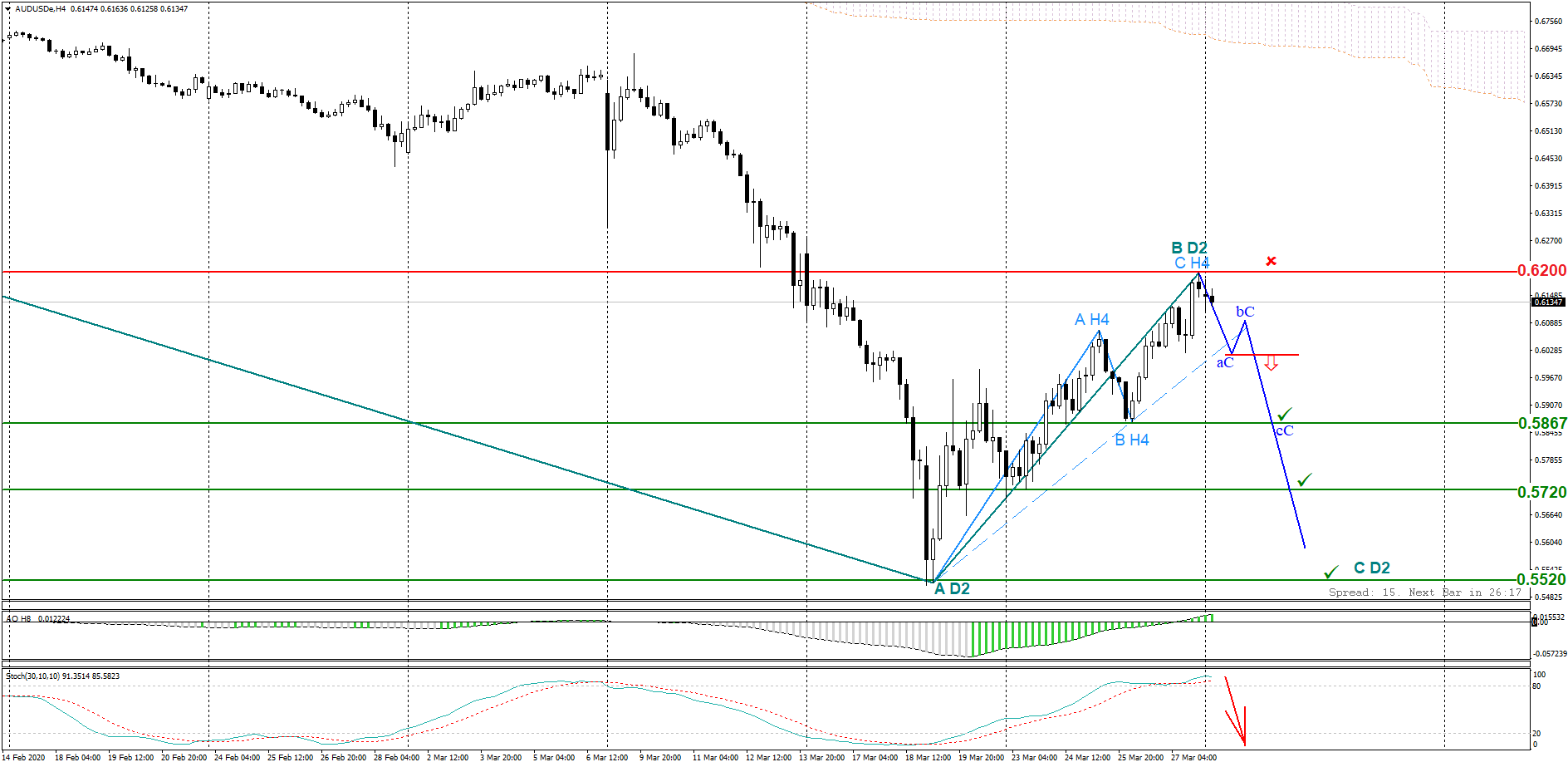

The overall trend is downward. Stochastic Oscillator signals overboughtness. The assumed D2 level wave B (H4 level pattern) has to be completed with a breakout of the inclined channel in order for the downtrend to continue. Keep track of the rate changes in real time.

Trading recommendations: sell while a descending wave pattern is forming, where the wave (aC) breaks through the inclined channel of the ascending pattern.

The overall trend is downward. The 164.0 resistance level is holding back buyers. A bearish divergence has formed on Awesome Oscillator, and Stochastic Oscillator signals overboughtness. A breakout of 154.50 will result in the formation of a 1-2-3 descending pattern within the overall downtrend. Keep track of the rate changes in real time.

Trading recommendations: sell below 154.50; Stop Loss: 64.00; target levels: 144.50, 137.30.

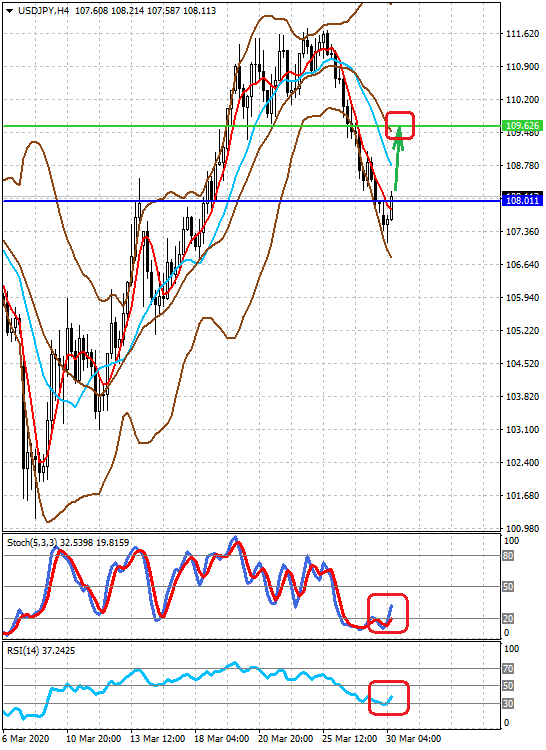

The observed local rebound in the European stock markets and the high likelihood that the same will happen in the US are supporting the pair. Due to the high volatility and large-scale stimulus measures by the Fed and the US Treasury Department, the demand for risk assets will gradually increase. The pair may be supported today because of this. Keep track of the rate changes in real time.

Trading recommendations: buy the pair after it consolidates above 108.00 with a likely growth to 109.60.

Visit the new section on Grand Capital website to monitor the rate changes of your preferred instruments and get useful information to help you decide on a trading strategy.

*Trading recommendations offered by analysts do not constitute a solicitation. Before starting to trade on currency exchange markets, please make sure that you understand the risks connected with the use of leverage and that you have sufficient level of training.