Tuesday, July 7th, today’s news—a decline is expected on the European markets due to the rising COVID-19 cases, and Germany's lower than predicted industrial production data. Treasury yields drop, Asian markets remain positive. The price of Brent oil is $42,72, WTI—$40.21. EUR/USD is at 1.1277, GBP/USD— 1.2478, gold is $1,786.05 per ounce. Read the daily selection of analytical reviews from Grand Capital experts to navigate the market during a time of volatility.

The topics of the new video by our Chief Analyst Vladimir Rojankovski include the market rally, news on major market players, what to expected from Tesla, DJI, and Goldman Sachs. Subscribe to our YouTube channel and never miss an update!

The pair is trading near the strong resistance level of 0.6560 following the RBA's decision to leave the interest rates unchanged. If the overall positive market sentiment persists, the pair will continue to grow. Keep track of the rate changes in real time.

Trading recommendations: if the price fixes above 0.6975, it will be able to rise further up to 0.7050.

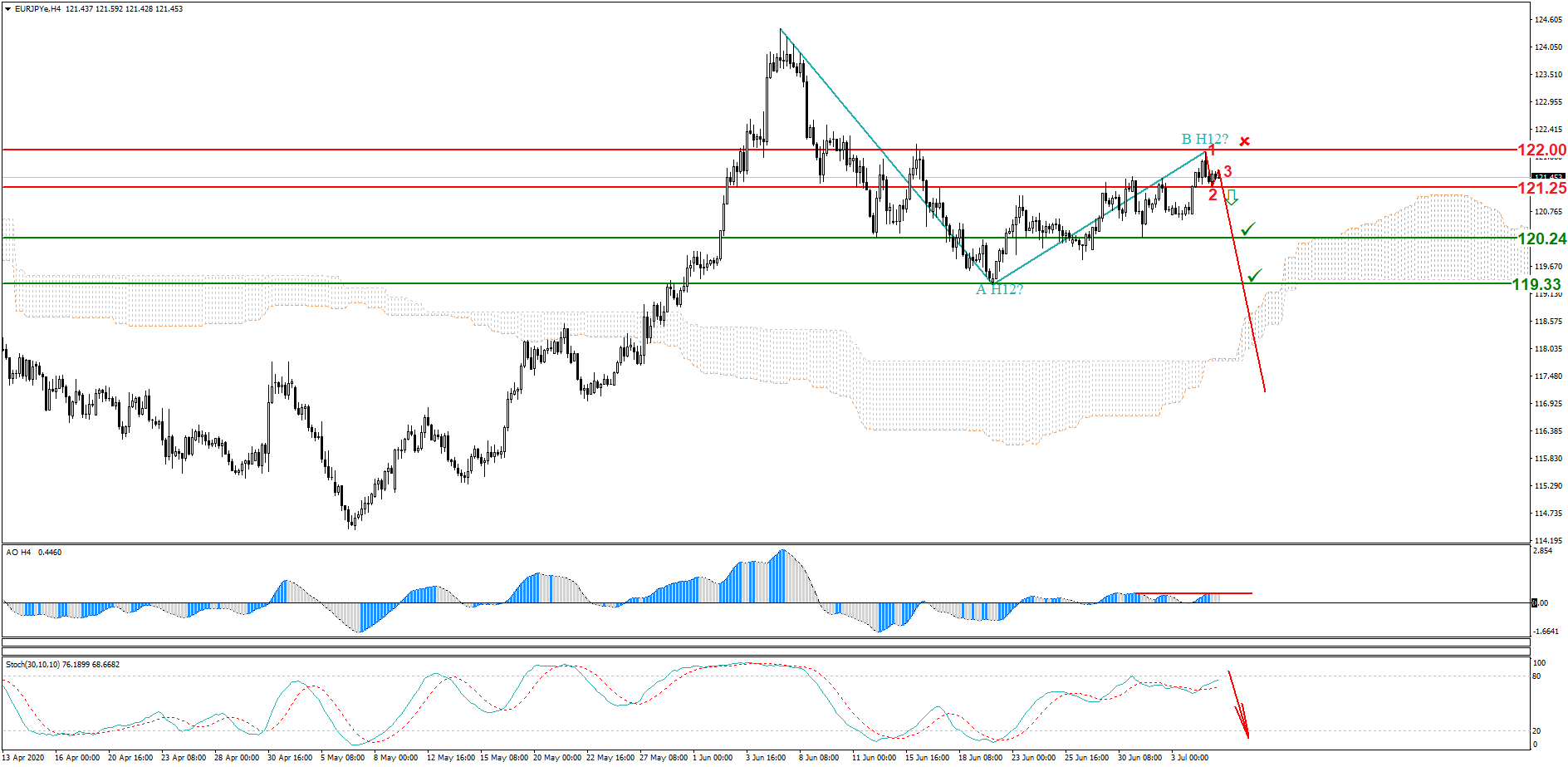

The resistance level of 122.00 held back the bulls. A bearish divergence has formed on Awesome Oscillator, and Stochastic Oscillator signals an overbought situation. A breakout of the 121.25 will result in the formation of a 1-2-3 descending pattern. Keep track of the rate changes in real time.

Trading recommendations: sell below 121.25; stop Loss: 122.00; target levels: 120.24, 119.33.

The support level 92.70 held back sellers. A bullish divergence has formed on Awesome Oscillator, and the moving averages of Stochastic Oscillator are directed upwards. Keep track of the rate changes in real time.

Trading recommendations: buy when an ascending wave pattern is formed above 97.70; Stop Loss under the support level of 92.70;; target levels: 101.50, 108.00, 113.50.

Visit the new section on Grand Capital website to monitor the rate changes of your preferred instruments and get useful information to help you decide on a trading strategy.

*Trading recommendations offered by analysts do not constitute a solicitation. Before starting to trade on currency exchange markets, please make sure that you understand the risks connected with the use of leverage and that you have sufficient level of training.