Friday, August 14th, today’s news—the lack of a new stimulus package continues to weigh on the US economy, the dollar is weaker, over 30 million Americans are unemployed. Weak China data signals a slower-than-predicted economic recovery, European markets await the Q2 GDP data. The price of Brent oil is $44.69, WTI—$41.98. EUR/USD is at 1.1805, GBP/USD—1.3065, gold is $1,960.30 per ounce. Read the daily selection of analytical reviews from Grand Capital experts to navigate the market during a time of volatility.

The pair remains in a short-term downtrend. The fundamental weakness of the US dollar, as well as a local increase in crude oil prices within a narrow flat range, may put pressure on the pair. Keep track of the price movement in real time.

Trading recommendations: if the pair falls below 1.3200, it may go further down to 1.3150.

The overall trend is upward. The price pivot zone of 1.7225 is holding back sellers. Awesome Oscillator indicates a bullish divergence. Keep track of the rate changes in real time.

Trading recommendations: buy when an ascending wave pattern is formed, where the wave (A) breaks through the inclined channel of the descending pattern.

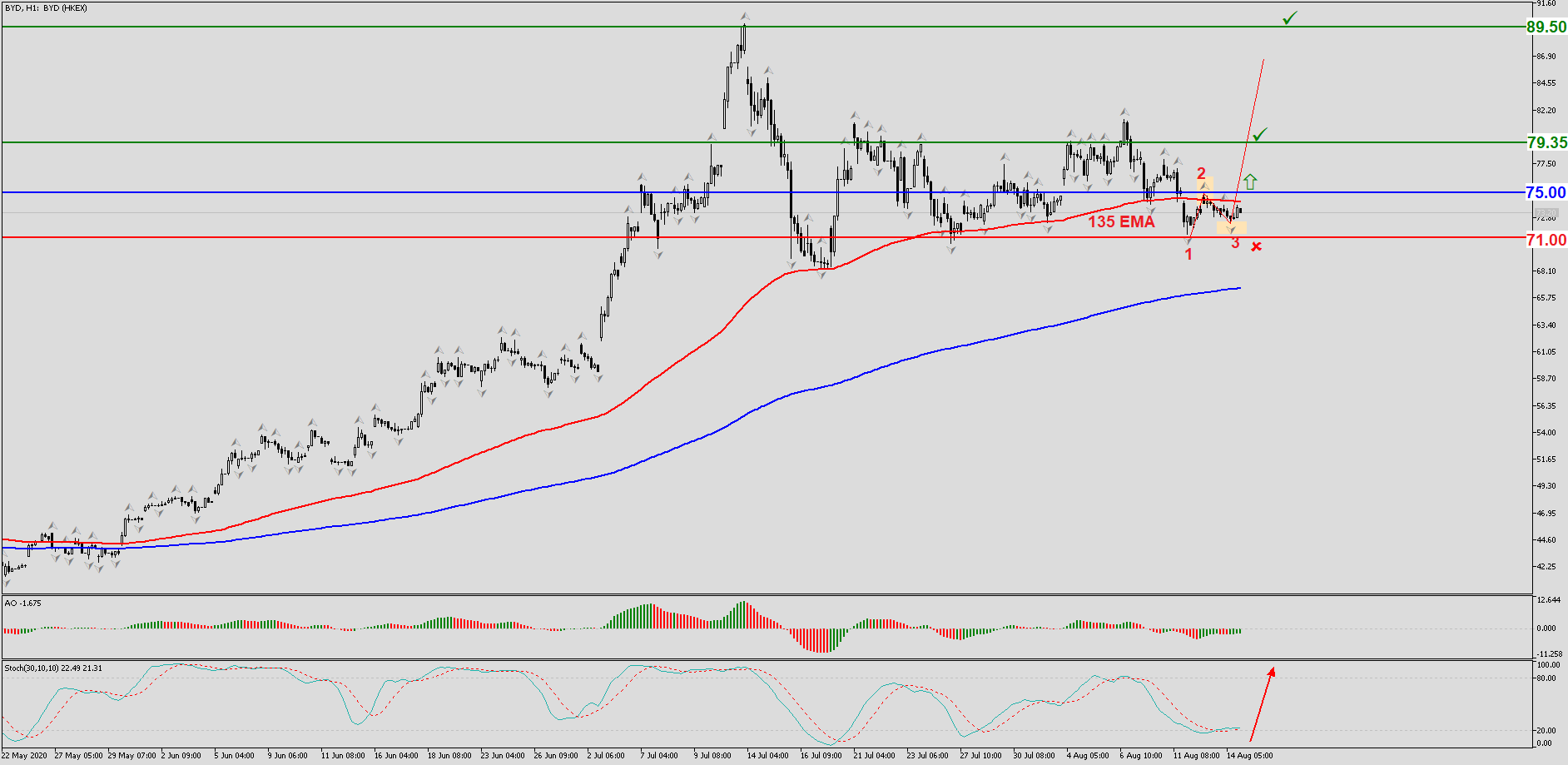

The overall trend is upward. The support level of 71.00 is holding back sellers. Stochastic Oscillator indicates an oversold condition. A start fractal has formed above the 135 moving average, followed by a signal fractal. A breakout of the start fractal will result in the formation of an ascending pattern of 1-2-3 within the overall upward movement.

Trading recommendations: buy above 75.00; Stop Loss: 71.00; target levels: 79.35, 89.50.

Visit the new section on Grand Capital website to monitor the rate changes of your preferred instruments and get useful information to help you decide on a trading strategy.

*Trading recommendations offered by analysts do not constitute a solicitation. Before starting to trade on currency exchange markets, please make sure that you understand the risks connected with the use of leverage and that you have sufficient level of training.