Regular winners of Grand Capital contests sometimes honestly admit to the use of Forex robots. Meanwhile, many participants use contests to test their trading strategies and will never trust an automated advisor. Let’s figure out which trading method brings more profit and has fewer risks.

Forex advisor or a robot is a piece of software for automated trading, which includes the analysis of market conditions based on a given strategy, entering and exiting the market, setting the position size and the limit orders with no actions required on the trader’s part.

Expert advisors can be divided according to:

Automated trading with advisors is available both in Trading Platform 4 and Trading Platform 5.

Automated trading can bring profit, but it also has weaknesses.

Key advantages of Forex advisors:

Disadvantages of trading robots:

All these pros and cons are relative, of course, but there is a fundamental difference between the automated and self trading: the human factor.

The robot decides to open or close a trade only when certain signals determined by the trading strategy appear. In case of a non-standard situation, it will continue within the logic embedded in it.

At the same time, the advisor is not able to assess the fundamental analysis factors, as a trader would do before deciding to enter the market. But the program will never make a mistake unlike beginners who often open positions of the wrong size or direction.

The expert advisor will never get tired and can trade around the clock. However, its trading activity can both generate profit and lead to losses. A series of failures would stop the trader, but the robot will be trading until it runs out of money or until the trader turns it off manually.

A trader’s profit is determined by their knowledge, practical skills, adherence to the rules of money management, and self-control. Profit made by an advisor is depends on the strategy it’s based on, the quality of the code, and its settings.

A trading indicator is a software program based on the visual interpretation of historical data. It examines the selected parameters of a currency pair within a certain time interval (market volatility, volumes, etc.) and, depending on its type, displays it as lines, bars, and other objects.

Several Forex indicators taken together make up a Forex strategy. A certain combination of their readings is a signal to open or close the position. Since any robot is based on a strategy, technical indicators are always among its elements.

The main difference between indicators and expert advisors is that an indicator only displays certain data, while an advisor uses this data to make a decision whether to enter or exit the market.

When choosing a trading robot, it’s recommended to adhere to the following rules:

1. Use only trusted websites: Trading Platform Market, official websites of brokers, or reputable Forex platforms;

2. Choose robots according to the situation you intend to use it in. A scalper advisor won’t work for trend trading;

3. If an advisor promises high returns, it’s almost always a sign of high risk. The maximum risks allowed by an expert advisor must never exceed the your money management system.

4. If possible, it’s recommended to try a demo version of the advisor or monitor its trading activity in real time on Myfxbook.

Unlike those found in Desktop platform, expert advisors in the new version of the platform offer a wider variety and more new parameters that can be added.

The advanced capabilities of Trading Platform 5, including the depth of market, separate accounting for transactions and orders, hedging and netting order accounting systems allow creating trading robots with new functions.

The special development environment MetaEditor is integrated into the platofrm, it’s designed to create expert advisors, while an advanced strategy tester allows assessing the trading robots effectively.

A little bit of practice. To install an expert in Desktop platform, copy the .mq4 or .ex4 file (open and compiled code, respectively) to C:\Program Files\Grand Capital Trader 4\MQL4\Experts. If the terminal is running, you’ll have to restart it.

When you run the terminal, all installed advisors will be displayed in the Navigation window.

Next, you need to double-click the left mouse button on the selected robot, or simply drag it onto the chart of a currency pair. The Settings window will open, where you’ll need to set the parameters.

In order to make the robot start trading, click the “Auto trade" button. If everything is done correctly, the name of the installed advisor and a smiley will appear in the upper right corner of the chart.

To understand how an EA works, configure it to suit a certain currency pair or asset, or choose the needed parameters, Trading Platform has a strategy tester that can be launched via the View button on the dashboard, or by pressing Ctrl+R.

To test a robot, you need to configure the settings. Open the settings by clicking the corresponding button.

An expert advisor can be optimized in the tester according to several key parameters.

Testing is conducted according to three models, you can choose a date, a timeframe, a currency pair, and spread. The report will be exported as an HTML file that can be opened in any browser.

An important factor for stable and profitable automatic trading is the conditions offered by the Forex broker. Grand Capital provides the most suitable conditions out there for robot trading:

A wide selection of currency pairs, metals, CFD and cryptocurrency is available for trading. No slippage and requotes in all account types, no disconnections that can disrupt the operation of an advisor.

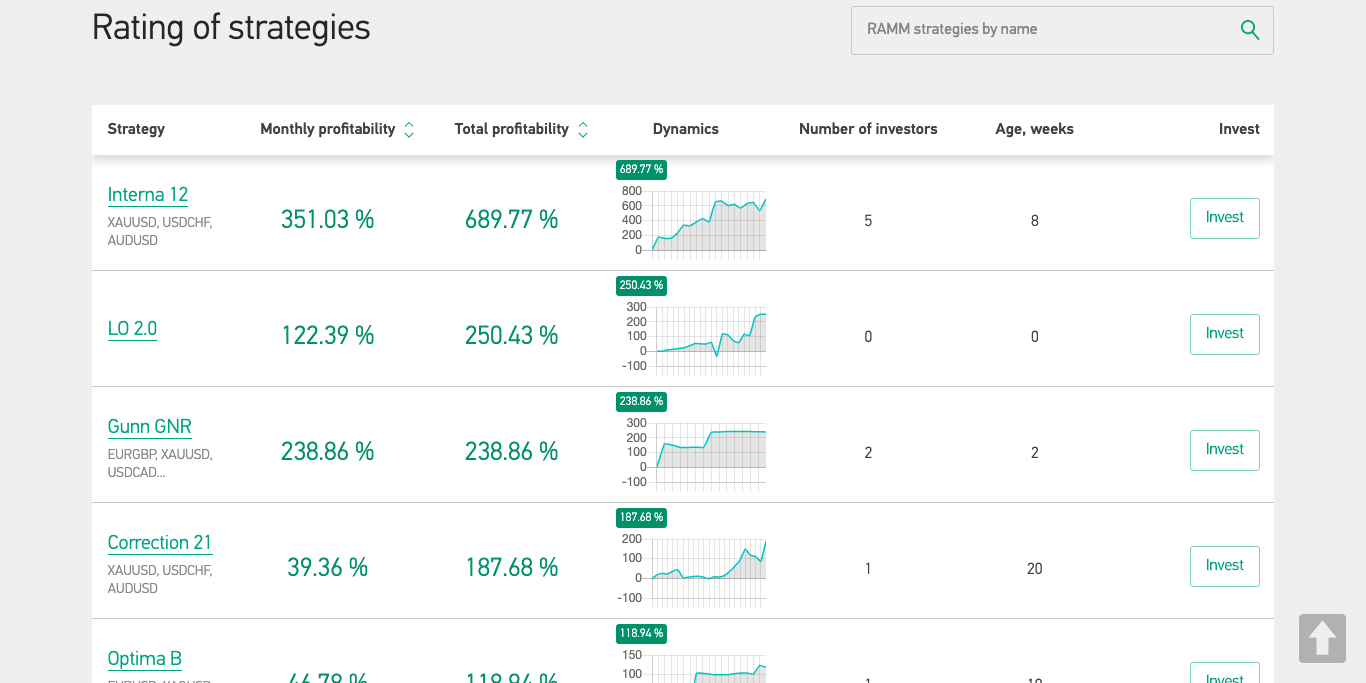

The use of Forex advisors allows Grand Capital to significantly increase the return rate of investments in RAMM accounts.

Novice trader or investor may choose one of the trading strategies in the rating and connect to it. All trades placed by the professional trader using this strategy (including those that employ robots), will be automatically copied to the investor’s RAMM account.

Compared to other types of investment, the RAMM system has the following advantages:

Open a RAMM account Choose a strategy

If you’re interested in classic investing, portfolios are the best choice. Investment portfolios are ready-made sets of over 330 financial assets (stocks, futures, metals, currencies), compiled by the company’s experts based on the expected returns and the stability assessment.

Investment portfolios offered by Grand Capital have a carefully balanced risk to profit ratio and can be formed to suit any budget, which makes it accessible even for novice investors.